When it comes to the details of your transfers, we know viewing them in the Orum Portal isn’t the final step. You need to understand trends, troubleshoot issues, and glean insights that could impact your business.

Not having this ability can mean slow customer service to your end-users and manual back-and-forth across teams.

At Orum, we’re committed to helping you understand historical transaction data and giving you the tools to build self-serve reports quickly. Today, we have a new feature to help you do just that.

You can now export transfer data directly from the Orum Portal — giving you the exact details you need to build custom reports.

Let’s take a closer look and see how it works.

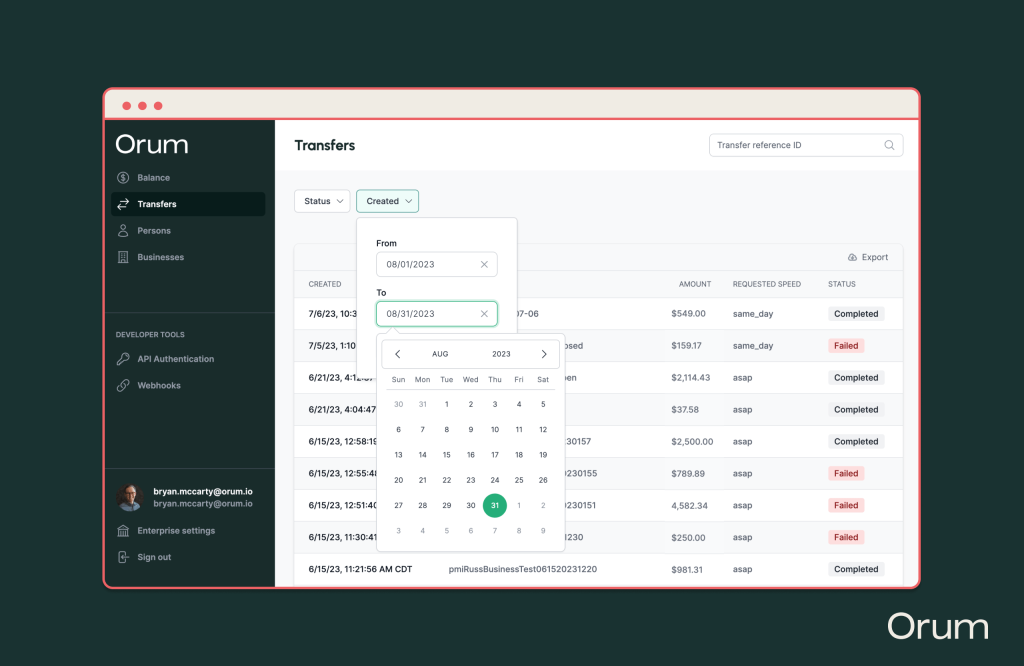

New Filter Options

You’ve always had the ability to filter by transfer status or reference ID. But there was no way to trim results by a specific timeframe. Now there is — with a new Created filter.

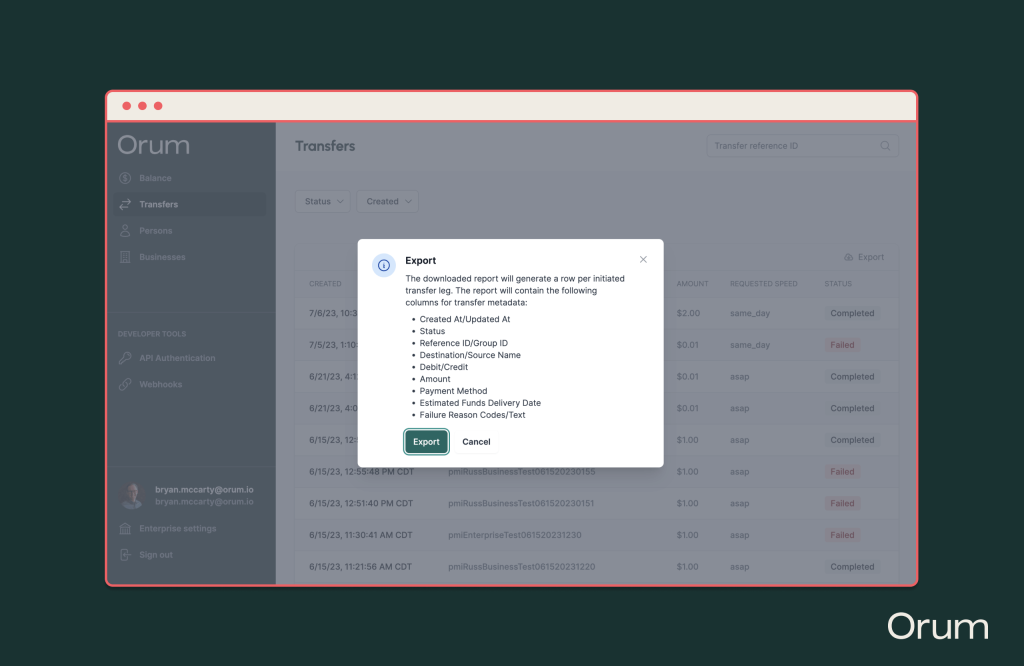

Export to CSV

After you’ve filtered and found the data you need, you can Export your report. The download generates a CSV with a row for each initiated transfer leg along with the following columns:

- Created At/Updated At

- Status

- Reference ID/Group ID

- Destination/Source Name

- Debit/Credit

- Amount

- Payment Method

- Estimated Funds Delivery Date

- Failure Reason Codes/Text

Coming Soon: New Reports Page and Balance Reconciliation

The CSV export is only the beginning for reporting in Orum. In the coming months, we’ll give you a dedicated Reports page. In addition, you’ll get a new report showing the impact of transfers related to your balance. This report will contain the following details:

- Transfer lifecycle: Shows multiple rows per transfer as it moves from pending to available.

- Balance impact: Shows how pending and available balance was impacted per transfer through the lifecycle.

Ready to Learn More?

Are you interested in a simple API for fast, reliable payments? With Orum you get one solution to access RTP, FedNow, Same Day ACH, ACH, Wires, and more. Schedule a demo today to see how you can implement 24/7/265 instant payouts into your tech stack without costly bank integrations or prolonged compliance.

Ready to dive in? Book a meeting with us today.