Orum recently launched Verify, a first-of-its-kind technology built on RTP and FedNow, that verifies Account Status within 15 seconds, determining whether a bank account is open and valid. Verify covers 100% of all U.S. bank accounts, consumer and business, and leverages real-time data, unlike other offerings that rely on batch systems and antiquated microdeposits.

For a refresher, watch Stephany Kirkpatrick, our CEO and Founder of Orum, introduce Verify to the world at the 2023 Fintech Demo Day by BCV, Nyca, and QED.

Today, we’re excited to build upon the success of Verify by announcing new features that validate Account Control. The modern solution uses a two-factor authentication that substantially reduces customer friction and ensures the results are deterministic, not based on scoring or probabilistic results.

We’re thrilled to now validate Account Control through Verify. Our solution is more accurate and faster than traditional offerings as we leverage modern two-factor authentication — and give our customers the ability to programmatically turn on and off this tier of verification as needed.

Let’s get into the details of how Account Control through Verify works.

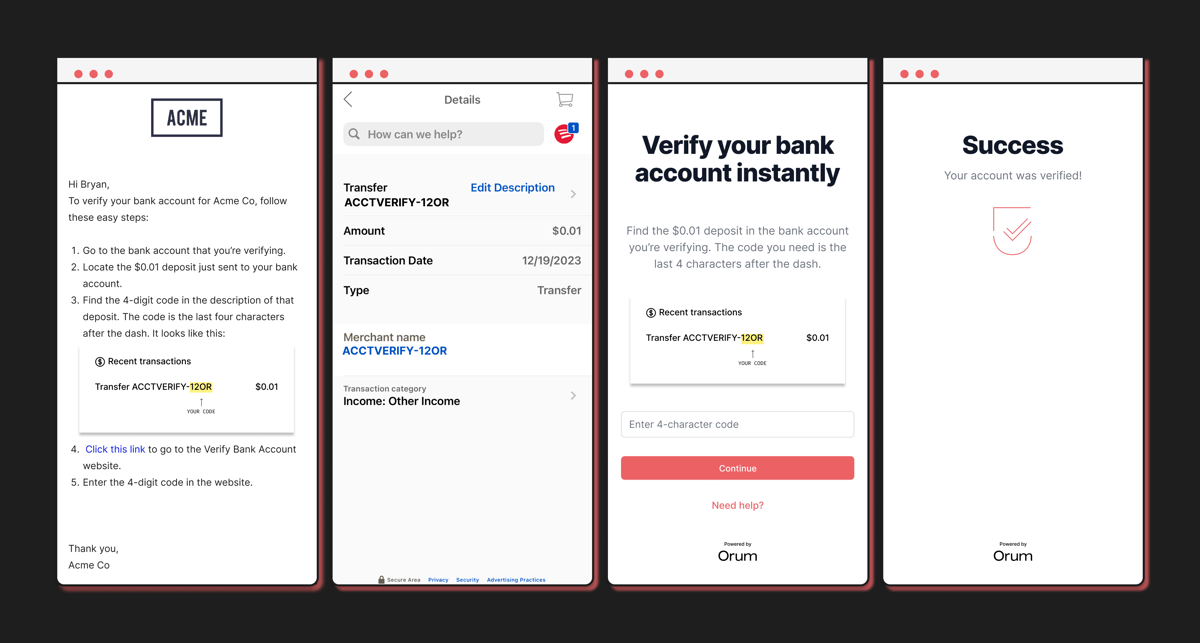

After Verify confirms the bank Account Status as open and valid, the next tier is validating that the person providing the bank account information is in control of that bank account. Historical methods of confirming control have been manual and slow, often requiring end users to wait days to find microdeposits in the account being verified.

Orum’s Verify API uses modern technology to bring our customers results that are more accurate and faster. The Account Control verification works in real-time by using two-factor authentication to confirm a random, four-character code sent via a real-time network ping. It’s through this innovative and seamless mechanism that Orum’s API confirms with both the enterprise (Orum’s customer) and the end user that bank Account Control has been verified.

This proof of Account Control is especially useful in B2B payments, where it’s important that the end user has access to that specific bank account.

Keep in mind that the Account Control tier of verification isn’t required for every scenario, so Verify users can turn the tier on or off programmatically as needed. In many instances, you will only need to confirm the Account Status to ensure the account is open, valid, and ready to receive payments. In other cases, you may want to confirm Account Control. That’s exactly why we provide flexibility in one solution — so you can fit the right verification needs into your various use cases.

Get Your Demo of Account Control Today

We’re not stopping with Account Status and Account Control. In fact, we’ve heard from many of you that validating Account Ownership via Name Match is useful to your business. Name Match confirms that the name provided by the person or business being verified is indeed associated with the bank account.

We’ll be rolling out this third tier of Verify at the end of Q1 2024, with Account Ownership via Name Match capability available at an additional cost per verification.

Getting Started With Verify

Orum can get you set up with Verify in as little as two days without costly bank integrations or prolonged compliance reviews. But don’t take our word for it. Check out the following case studies to read about real-world applications and practical use cases:

Ready to Learn More?

Experience a personalized walkthrough with our experts and see firsthand how our solutions can tackle your biggest challenges. Schedule a demo today and take the first step towards transforming your payment processes.