At Orum, we’re all about automating and optimizing money movement and providing instant bank account verification to help you grow your business.

Launched in 2017, real-time payment (RTP) transfers offered a cutting-edge method for money movement within the United States. RTP now accounts for millions of transactions each month, with 74 million transactions in Q4 of 2023.

So why do 86% of businesses with $500M-$1B in annual revenue use RTP for their payments?

The primary advantages of RTP include:

- Cash Flow Control

- Speed

- Adaptability

To truly understand this payment rail and its key benefits, let’s take a quick look at what it is, who runs it, and how it all works.

What is the Real-Time Payments network?

The Clearing House launched the Real-Time Payments network as a new type of electronic payment architecture.

It’s the first implementation of real-time payments in the US and has the following features:

- USD domestic payments (within the US)

- Payments are processed 24/7/365 with no bank holidays or interruptions

- Immediate settlement

- Instant funds availability

The Real Time Payments network is overseen by The Clearing House. They define any relevant operating rules for all participants in the RTP Network.

Where can real-time payment transactions be used?

The RTP network works with all major types of transactions for consumers, businesses, and public organizations . Transaction types supported include:

- Peer-to-peer (P2P)

- Account-to-account (A2A)

- Business-to-business (B2B)

- Business-to-consumer (B2C)

- Consumer-to-business (C2B)

- Government-to-consumer (G2C)

- Consumer-to-government (C2G)

Is there a maximum transaction amount for sending money through RTP?

As of April 18, 2022 transactions up to $1,000,000 in value can be sent as real-time payment.

A financial institution can set up a lower transaction limit for their customers when sending transactions, but not when receiving them. This means that in a hypothetical transaction from your ABC bank account into a receiving party’s XYZ bank account:

- Your ABC Bank can limit your transaction value, as the sender, to lower than $1,000,000

- XYZ Bank, on the other hand, cannot limit the recipient to receive less than $1,000,000.

How does an RTP transaction work?

You can only move money through real-time payments with credit push transactions. This means that the person sending a payment has to initiate the transaction.

Payments are processed individually in real-time with no holidays or breaks. So you can send a payment at any time of day, any day of the week, any week of the year regardless of whether your transaction falls within standard banking hours or working days.

All payment settlements are final and irrevocable, with no options for chargebacks or reversals.

Payment status updates instantly for both the sender and receiver, so both parties know whether a transaction went through successfully and the amount paid.

What’s a request for payment (RfP)?

Since you can only send money through real-time Payment using credit push, you cannot initiate transactions to pull money out of a sender’s account.

Instead, RTP provides an ability for billers to send Request for Payment (RfP) messages. You can think of an RfP as an invoice native to the RTP rail. These messages ask the sender, typically a customer, to send a specific payment to the biller.

The sender can then respond to this RfP by initiating that payment from their end as a credit push transaction.

What messages does RTP send?

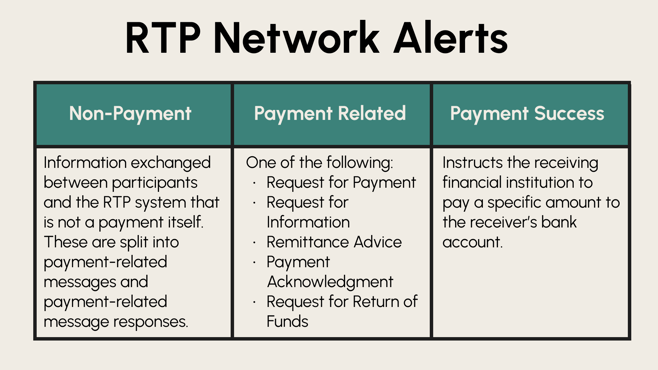

The RTP network can send several types of alerts to either the sending or receiving participants in a payment. Possible messages can be broken down into three main categories:

When real-time payments are settled, both the sending and receiving financial institutions get a message as to the status of that payment. These messages look as follows:

- The sender will get a message stating “Payment Received” immediately as the payment is sent.

- Senders can also get a message stating “Payment Posted” once the payment is not only received but properly posted to the receiver’s account.

Characteristics of RTP transactions

Who can use real-time payments to move money?

While the RTP network is available for opt-in to all federally insured banks and financial organizations, not everyone has enabled RTP capability.

The Clearing House estimates that RTP works with financial institutions holding 75% of American demand deposit accounts (DDAs). The institutions currently integrated with RTP can be found on the Clearing House’s website.

Financial institutions can work with the RTP Network as :

- Funding Participant: A Participant that is party to the RTP Prefunded Balance Account Agreement and that (i) requests and receives disbursements from the Prefunded Balance Account and ii) if the Participant is a Sending Participant, pre-funds for itself in accordance with these RTP Participation Rules and the RTP Operating Rules.

- Non-Funding Participant: A Participant that is not a Funding Participant and that has designated a Funding Agent to act on its behalf to pre-fund in accordance with RTP Participation and Operating Rules

- Receiving Participant: The Participant that holds the Receiver’s Account and that receives an incoming RTP Payment Message.

- Sending Participant: The Participant that holds the Sender’s Account and initiates a Payment Message.

How long does it take to process real-time payments?

RTP transactions are completed in real-time. This means that your payment will be processed and available for use immediately (usually within 15 seconds).

How much does it cost to process real-time payments?

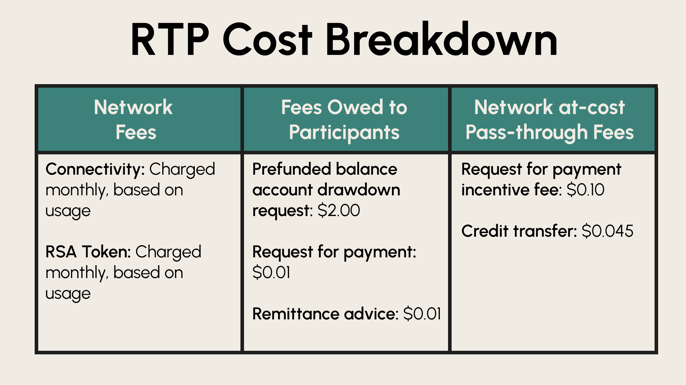

All RTP transactions are charged at a flat fee based on the operation completed.

Charges are split into the following three categories:

- Network fees

- Fees owed to participants

- Network-at-Cost Pass-through fees

The exact costs from the Clearing House are broken down as follows:

Exception scenarios for RTP

Since payments with the RTP system require opt-in and explicit enrollment, a variety of exceptions can occur.

Typical exception scenarios for billers trying to implement RTP for their customers to pay them could be:

- Customer unable to receive RfP

- Customer declines an RfP

- RfP expiration

- Biller cancels an issued RfP

- Failed real-time payment

- Error made on payment

- Abuse by billers

The solutions to these exceptions vary based on the exact situation. As the biller, you may wish to use another payment rail, change payment preferences for RTP, request another transaction, manually refund your customer, etc. The Clearing House provides further guidance in this document.

Advantages of using RTP for money movement

Cash flow control

Since RTP payments are processed in real-time, you can control your cash flow more precisely than with delayed and batched payment systems such as ACH, paper checks, or wires.

RTP also allows you to process payments at any time. Unlike other payment rails, which only settle during banking days and hours, with RTP a business can receive money from customers on the weekends, at night, or on holidays giving back a level of control over finances.

Speed

Since funds are deposited immediately, the receiving party gets their money when they need it.

RTP is great for any urgent transactions and emergencies whether the receiving party is an individual consumer, business, or a government organization.

Adaptability

With RTP, money can be sent as often as it is needed, adapting to the specific needs of each situation and participating party.

For example, hourly workers can be paid at the end of each workday according to the exact hours they’ve completed that day. On the other hand, salaried employees can still be paid on a more spread out schedule, whether biweekly or monthly.

Disadvantages of using RTP for money movement

Costs

As outlined above, the Real-Time payments network charges flat fees to all participating financial institutions.

So for banks, the costs of using RTP do not change based on an organization’s size, payment volume, or minimum payment thresholds. However, banks can set up custom pricing for real-time payments. This means that for organizations and consumers, using this payment rail might get quite expensive.

In addition, setting up the technology necessary to work with the RTP system involves significant upfront investment. 20% of companies say that the costs required to implement RTP are the main reason that they haven’t used this payment rail.

Fraud

If an RTP was made fraudulently, the sender can try to contact their financial institution. However, since there’s no cancellation mechanism and payments are completed in real-time, there is no guaranteed way to reclaim any money sent through the RTP rail.

Lack of adoption

Not all US financial institutions have opted in to use the RTP system so far.

Since there is no mandate to take part in this new payment rail, a lot of smaller financial institutions are choosing not to invest in the necessary infrastructure and are sticking with more traditional forms of payment.

No reversals or chargebacks

All RTP payments are final. Once the money has been sent, there is no easy way to get that transfer revoked or canceled.

Since payments are settled instantly, you don’t have a window to potentially recall a payment that was made as a mistake or sent to a fraudulent receiving party.

So whenever you are initiating an RTP transaction you have to double-check all the transaction details.

How you can benefit from a real-time payment provider

Orum.io is passionate about helping you move money via Real-Time Payment (RTP), or any payment rail, without the hassle and risks you may face by initiating those transfers yourself.

We can automatically determine the best possible speed for your transaction, picking between RTP or other payment methods. On top of that, our smart routing system can mitigate the risks of financial fraud and identity theft with any RTP transfers you conduct.

Looking to enhance transaction speed and security? Get in touch to see how Orum’s real-time payment technology can address your challenges and optimize your payment processes.