Here's how Orum unlocks fast, reliable money movement for brokerages to grow revenue and user engagement

Speed is vital to online brokerage platforms whether their end users are investing in stocks, bonds, options, or other assets to maximize returns. So why do so many brokerages rely on slow, antiquated payment rails that hinder how fast end users can move their own money?

Public.com teamed up with Orum to provide their users with instant access to funds by launching RTP using Orum’s Deliver API. Orum’s customers go live in 2 weeks or less – saving the considerable time and money that it would cost to connect directly to a bank. Unlike a direct connection to a bank, Orum’s solution also delivers access to FedNow, RTP, Same Day ACH, ACH, and Wires, all via one integration. Plus Orum’s smart routing optimizes and orchestrates the money movement based on speed and cost parameters.

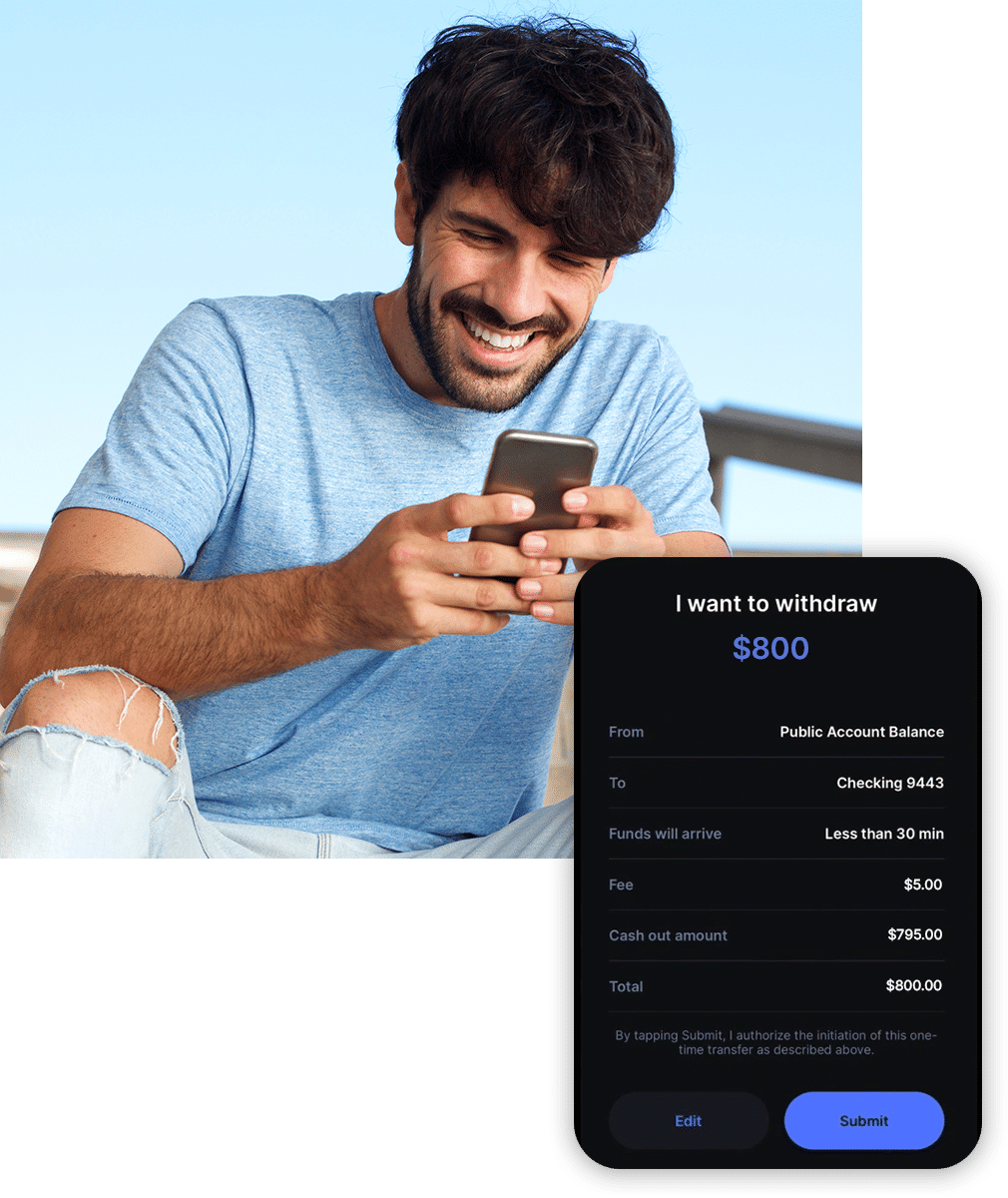

Public.com uses Orum’s API-based solution to transform its payments operations. The API determines instantly whether an end-user is eligible for RTP payouts and then offers the feature only to those end users to drive engagement and revenue while optimizing the customer experience.

Would your brokerage or business benefit from similar features?